For the Crisis and Response of the Great Depression in the US

By Nicolaus Hartoyo and Gabriel CurraNagasawa

Link back to the video: YouTube

Link back to the bibliography: Bibliography

Link back to the menu: Menu

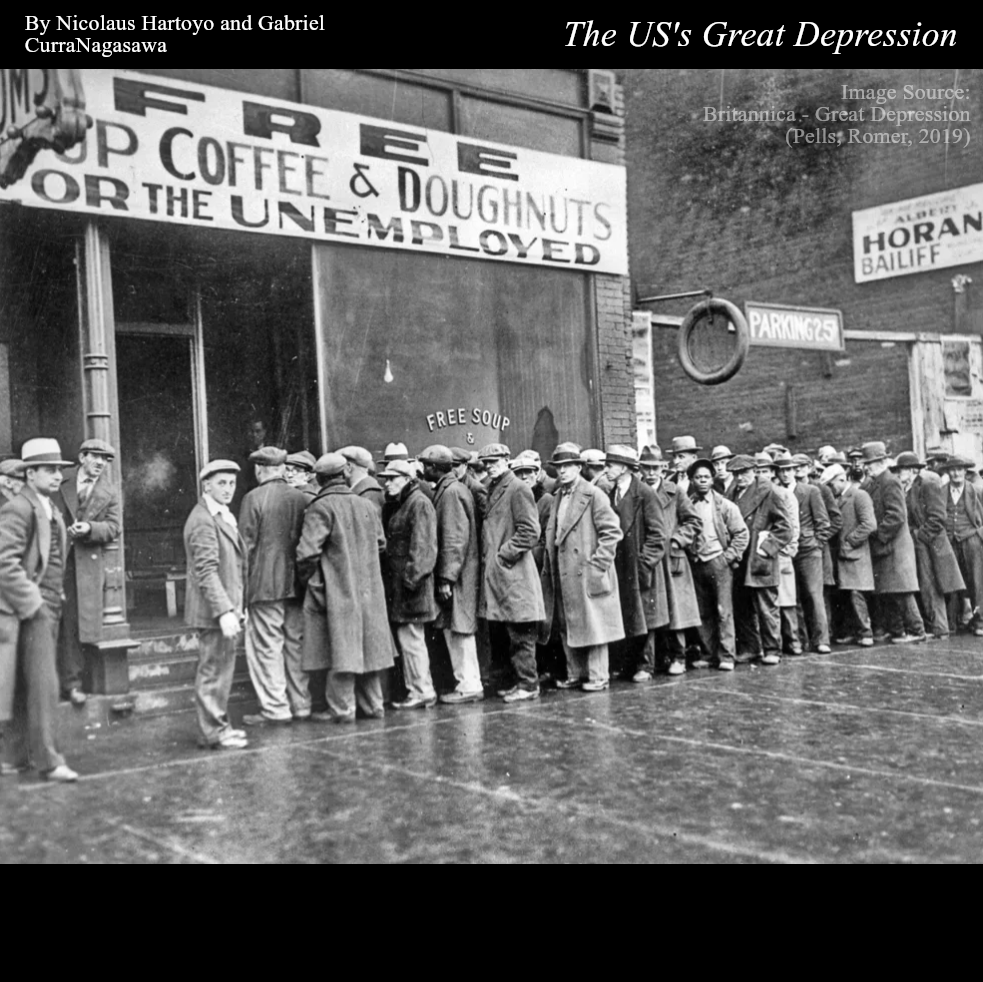

The year is 1929. Republican Herbert Hoover was just inaugurated into office, and things are good, or at least, they're looking good. But nothing. Nothing looks better than the stock market right now. This was the view shared by not just the wolves of Wall Street, but even ordinary men and women, who, in speculation of the seemingly ever-rising stock prices, invested significant volumes of cash into the Dow Jones, often taking out loans from banks or mortgaging their homes to build up the capital to do so(Tikkanen, 2018). This widespread speculation and investment continued as the stock market became supposedly more lucrative, driving up the average price of a stock to a high of 381 points(Richardson, 2013), until it formed what is known as a "bubble". A financial bubble is a situation where share prices exceed their assets' actual value. Eventually, this bubble "pops", caused by something that investors interpret as a threat, such as a negative political or economic event(Kenton, 2022). Not wanting to lose the value of their large investments, buyers became sellers, and on the 29th and 30th of October, on days known as Black Monday and Tuesday, the Dow Jones lost over 12% on each day as a result of frantic selling, which incited even more frantic selling(Tikkanen, 2018). This was the Wall Street crash of 1929 and marked the start of the Great Depression. Despite efforts from banks and the government to calm the masses(Tikkanen, 2018), the damage had been done, and the same ordinary men and women who had loaned money to invest with found themselves with no savings, in heavy debt and without their livelihoods, as the businesses they worked for failed when the value of their shares were vaporised(Richardson, Komai, Gou, Park, 2018). As the unemployment rate soared to over 20%, people lost their faith in the economy, and spending decreased, which made the US's GDP suffer a 30% drop(Tikkanen, 2018). With people lining up for bread queues in droves and newly impoverished families migrating for work when their properties were seized by banks, it was clear the US had fallen into crisis. The government had to do something: they had to respond. So what did they do? Who did it? How effective was it?

The year is 1933. Democratic Franklin D. Roosevelt(Miller Center, 2018) was just inaugurated into office and things are bad. Or, at least, they're looking bad, because in response, behind the scenes in Congress, Roosevelt has a new deal in plan for the American people. On just the second day of his presidency, Roosevelt declared all financial institutions to be closed for a four-day "bank holiday" to halt the damage to the nation's banks when large numbers of depositors withdraw their money in "bank runs" and "banking panics". On the fifth day, Congress met to start a three-month long special session to be known as the "Hundred Days" where many of the programs and reforms of New Deal were put into motion. (Miller Center, 2018) Significant programs include: The Civilian Conservation Corps, which provided jobs for unskilled and unemployed young men by concerning itself with land conservation and development. They maintained and constructed paths, planted trees, and took measures to prevent wildfires and soil erosion in national park areas(Britannica, 2019). Over the course of the Great Depression, the Civilian Conservation Corps employed over 3 million people(McKee, Walker, n.d.). And the Tennessee Valley Authority, which was established to contribute to the development of impoverished regions in and around Tennessee by improving river infrastructure with dams to produce hydroelectricity and demonopolize electricity, control floods, support workers in agriculture, and provide jobs in construction(Britannica, 2019)(TVA, n.d.)(McKee, Walker, n.d.). An example of a significant reform was: The Agricultural Adjustment Act, aimed to bring stability to the agricultural sector, which had seen abysmal prices for farm goods as a result of production surpluses brought over from World War One. Farmers were paid to destroy or not plant as many crops and cull livestock to eliminate these surpluses. The act even distributed subsidies for certain crops and animals, provided relief payment to families, and refinanced mortgages to favour farmers more kindly(Metych, 2023)(McKee, Walker, n.d.). The Civilian Conservation Corps and the Tennessee Valley Authority were just two of the numerous alike programs targeted to alleviate the pressure on unemployed families, while the Agricultural Adjustment Act saved farmers from bankruptcy and put into place legislation that persists today(Britannica, 2019).

The gold standard was a monetary system where the value of the basic unit of currency is made equal to a fixed quantity of gold. It was used by the US and much of Europe and made foreign exchange rates and prices stable(Britannica, 2024)(Lioudis, 2022). However, when the stock market crashed in New York in 1929, it was the gold standard that caused countries all the way across the Atlantic Sea to lose the value of their currencies too. As the US economy declined, foreign gold outflowed into the US because of the gold standard. So, foreign banks tightened interest rates to try and hold onto it, but to keep up with the deflation happening in the US, it was too much to ask for, as inflation also represses spending and often leads to unemployment(Tikkanen, 2018). As the gold standard and measures to preserve it acted as some of the major conspirators that caused the Great Depression, it isn't surprising that abandoning it would help countries recover from it(Tikkanen, 2018). In the US, again, it was Franklin D. Roosevelt who in response of the Great Depression, abolished the gold standard(Miller Center, 2018) and introduced the fiat currency used to this day, where money's value is not backed by tangible assets but instead made to be legal tender by the government(Chen, 2021). While it resulted in the devaluation of the US dollar, it meant that governments could now control the money supply, printing more physical cash to encourage spending and stimulating the economy(Tikkanen, 2018). The effects of scrapping the gold standard became very apparent. The effect of this in the US was that the money supply rose by almost 42% in 3 years and gave way to signs of recovery. For instance, as the government was now printing as much money as it saw fit, people predicted that inflation was probably just around the corner(Tikkanen, 2018). With this, borrowing and taking out loans became more attractive, as inflation means the money from their pay checks becomes more valuable, but their debts incurred before inflation would stay the same, letting them pay them off easier(Segal, 2023), this borrowing further stimulated the economy, setting the US on the path to recovery.

World War 2 was one of the factors for the end of the Great Depression. In the US it created around 17 million new civilian jobs(Goodwin, 1992) for the war efforts in domestic industries such as manufacturing, industry, and service jobs. It caused industrial productivity to increase by 96%(Goodwin, 1992) and it increased corporate profits. The new jobs created during World War 2 gave many civilians an opportunity to get out of the economic recession too. The mobilisation of the US workforce during World War 2 also played a crucial role in alleviating the economic hardships. Another thing was government spending at the start of World War 2. The injection of funds into war-related export demands and greater government expenditures played a huge part in starting economic growth. The investment in defence, infrastructure, and the war itself is what resulted in new jobs being created. Another significant aspect was the redirection of resources towards military equipment and supplies, which fuelled industrial production. The technological advancements during World War 2 helped to stop the Great Depression by increasing demand for the military technologies such as radars, aircrafts, tanks and communication systems(Mindell, 2019). This shift towards technological advancements revitalised industries. The increase in demand drove innovation and stimulated economic growth by creating many new jobs in the manufacturing industry. The start of World War 2 was an important factor in ending the Great Depression by creating new job opportunities through government spendings and new technologies.

The Great Depression was a crippling and severe economic crisis that started in 1929, caused in the US by the collapse of the stock market on Wall Street, New York, to which the repercussions of the crisis forced millions of Americans into poverty and unemployment and thousands of businesses and banks into bankruptcy. However, through the US's response, consisting of policies that concerned nationwide programs and economic reforms, the abandonment of the gold standard, and the onset of World War 2 brought the US out of the worst economic crisis in history in 1939, just ten years later.